The Innovating Justice Fund takes centre stage as the first-of-its-kind investment fund exclusively dedicated to advancing SDG 16: ensuring equal access to justice for all.

With a relentless focus on empowering people and fostering innovative solutions, this visionary fund provides critical funding and support to early-stage ventures operating in emerging markets, revolutionising the landscape of people-centred justice.

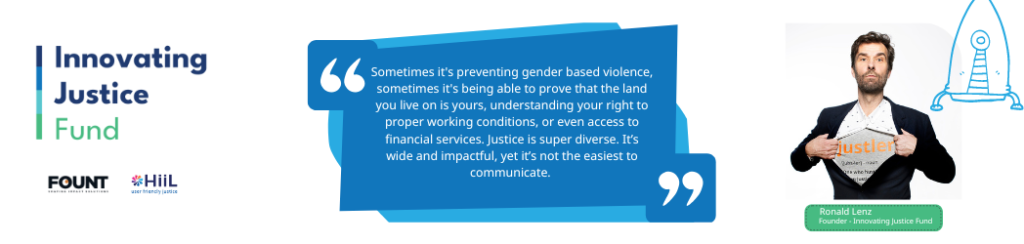

To understand the driving force behind the fund’s inception and explore its far-reaching impact on justice everywhere we sat down with Ronald Lenz,Founder of the Innovating Justice Fund.

How did the fund start?

HiiL has been supporting startups for over a decade. It began with an award to recognize innovations in the justice sector. Later, it evolved into full life-cycle support. After having done this for so long, we have supported over 170 startups, we observed that around 5 to 10% of them were scaling. They weren’t mature enough for Series A, but they did need capital to grow and survive. We noticed that all the attention goes to Climatetech or Fintech, but not as much to Justice-tech. As an NGO that supports justice startups, we wanted to prove the concept. We initiated an impact investment fund to demonstrate the viability of making investments in startups in this sector.

Can you provide an overview of the Innovating Justice Fund’s mission and how it addresses the justice gap in Africa and the MENA region?

At HiiL, we’re committed to people-centred justice. The way we work with startups is integrated into a larger, comprehensive approach. Startups are one of the engines we need to close the justice gap. Even if there is innovation in the public sector, we cannot rely solely on it. We need other players to enter the market and deliver justice to people. The demand is simply too big. We aim to create synergy between the public and private sector. Startups can achieve people-centred justice, and our mission is to invest in them to help scale their impact to other markets and communities.

What motivated the establishment of the fund, and what specific challenges or gaps in the justice sector did you seek to address?

We basically work based on data. With the services that we provide, we ask people about their justice problems and how their justice journey looks, giving us valuable insights into these issues on a country-specific basis. So, based on this data, we also select the startups that we support. There are consistently the top 5 or 6 problems that we observe everywhere, and we do focus on addressing a range of those justice issues.Those are Land and Property Rights, Employment Justice, Family Justice, Crime and Neighbour Disputes

Could you share some success stories of startups or scaleups supported by the Innovating Justice Fund, highlighting the positive changes they have brought to communities and individuals?

Sidebrief, Haqadarshak, Iverify, and Peleza are shining examples of startups that have not only disrupted their respective industries but have also made a significant positive impact on their communities.

Sidebrief’s innovative legal platform has provided accessible legal services to countless SMEs and startups, which in turn makes it easier for them to start and grow their own companies.

Haqdarshak makes it easier and more efficient for citizens to apply for various welfare programs. By empowering citizens with knowledge and access to benefits, Haqdarshak enhances the ability to demand and claim their rights. They also focus on reaching marginalised and underserved communities, including rural areas and remote regions. By doing so, it ensures equitable access to government resources and support. Their services impacted more than 280,000 citizens, and over 37,900 microbusinesses to this day.

Iverify’s tech-driven solutions positively impact communities by enhancing security through accurate identity verification, reducing identity-related fraud, and fostering trust among community members. Additionally, its services support financial inclusion by enabling access to financial resources for individuals without traditional identification documents. By streamlining identity verification processes, Iverify contributes to community efficiency and overall well-being. Peleza’s unique approach to identity checks led them to develop a fully automated system to ensure clients can request for background screening/checks. By doing so, they allowed thousands of people to get access to decent employment and financial services.

How do you identify and select startups and scaleups for investment? What criteria do you consider to ensure both financial viability and social impact potential?

We consider several criteria in our evaluation process. This includes assessing the impact a startup makes and the alignment of their impact thesis with the mission of the fund, which directly relates to SDG 16 and people-centered justice. Additionally, we examine various sustainability factors, such as the business model, team, governance, and financial structure. Startups should meet a specific threshold for revenue and impact, demonstrate a solid product-market fit, and have a clear go-to-market strategy with substantial traction. They should also present a well-defined expansion plan while seeking support. Ultimately, our investments aim to facilitate the scaling of ventures beyond their current market.

In what ways does the Innovating Justice Fund go beyond traditional financing to provide support, mentorship, and capacity-building to the companies in its portfolio?

We aim for long-term partnerships with these ventures, collaborating with them from an early stage and nurturing enduring relationships. We offer mentorship, coaching, and a customized scaling program to prepare startups for investment. Following funding from the fund, we provide a technical assistance program to help them achieve significant milestones. Our organization has hubs in Nairobi, Lagos, and Tunis, ensuring localized support. We maintain direct connections and remain actively engaged, tailoring our involvement to the specific needs of each venture.

What are some of the key challenges you have encountered in supporting justice-focused startups and scaleups, and how have you overcome them?

One challenge is that we’re still pioneering impact investing, and even supporting justice-tech startups is still in its early days. While we have a long history in this field, it’s not yet commonplace. We’re moving toward a point where its significance will become very apparent. We need to evangelize this and showcase it to the impact investment community, which might have overlooked it.Sometimes justice-tech is preventing gender based violence – being able to prove that the land you live on is yours, understanding your rights as an employee, abiding by proper working conditions, or even access to financial services. Justice is super diverse. It’s wide and impactful and it’s not the easiest to communicate.

How do you measure and track the impact generated by the Innovating Justice Fund? What metrics or indicators do you use to evaluate the success of your investments?

We have an impact framework with very clear indicators designed for preventing or resolving justice problems. We use this impact framework for the fund, incorporating it directly. It’s a comprehensive metric that considers both direct and indirect impacts. We continue to learn and refine our system. While we have a solid system in place, there’s no industry standard for this. In the impact investment space, various funds develop their own frameworks, similar to what you see in the climate space.

Looking ahead, what are your aspirations and goals for the Innovating Justice Fund?

First things first, we’re in a proof of concept phase. We want to showcase a portfolio of 8 investments. We want to show that this sector is investable.

How can potential investors and partners get involved with the Innovating Justice Fund? What opportunities exist for collaboration and engagement?

We are currently making investments while simultaneously fundraising. It would be great to have investors on board who also understand this sector. We adopt an ecosystem approach, and we see an opportunity to fund programs. Additionally, spreading the word about the opportunity to invest in Justice tech startups is something we would greatly welcome.